Your Competitive Analysis Framework Blueprint: Turning Insights into Action

Build a winning competitive analysis framework with our step-by-step blueprint. Turn market data into actionable strategies and gain a sustainable edge.

A competitive analysis framework is your playbook for outmaneuvering the competition. It's a structured system for consistently finding, collecting, and transforming information about your rivals into actionable strategies. This isn't about creating a one-off report that gathers dust. It’s about building a continuous process that turns raw data into a real strategic edge, helping you make proactive decisions instead of just reacting to market shifts.

Think of it as your repeatable blueprint for making sense of the market and taking decisive action.

Why Ad-Hoc Competitor Research Fails

Picture a pilot trying to fly cross-country without a flight plan. They might point the plane in the right general direction, reacting to storms as they pop up and hoping to land somewhere near their destination. This is how too many businesses approach competitor research—sporadic, gut-feel check-ins whenever a new rival launches a product or a big sales deal is lost. This is ad-hoc analysis, and it's a recipe for flying blind.

When your research is just a series of random check-ups, you get a warped view of the market. You might panic and overreact to a competitor's minor price drop while completely missing their strategic pivot into a new customer segment. Without a system, you're always one step behind, stuck in a constant cycle of reaction. This is where a competitive analysis framework completely changes the game. It gives you the structure—the flight plan—to anticipate your competitors' moves, capitalize on their weaknesses, and clearly understand your own position.

Moving from Reactive Chores to Proactive Intelligence

A solid framework turns competitor research from a dreaded, mind-numbing task into a wellspring of continuous strategic insight. Instead of randomly glancing at a competitor's website, you establish a systematic process to monitor key signals across their entire business. This structure is what turns scattered data into winning moves.

The biggest flaw with ad-hoc research is its lack of consistency and context. What you learn in January is forgotten by March, and you have no baseline to measure change. A competitive analysis framework fixes this by creating a reliable, repeatable process designed to help you win your market.

A formal framework forces you to define what victory looks like, identify the most important battlegrounds (like pricing, features, or marketing), and consistently measure your performance against rivals.

This kind of structured thinking isn't exactly new. The whole field of competitive analysis has been heavily influenced by strategic consulting firms. Take the Boston Consulting Group’s Growth-Share Matrix from the 1970s, which gave companies a systematic way to classify their business units. This idea took off globally; today, an estimated 68% of Fortune 500 companies use portfolio analysis tools based on this model to decide where to put their money. Businesses that apply these frameworks report much higher success in anticipating what their competitors will do next, with some studies showing a 25% improvement in hitting market share goals. You can explore more about the history of these strategic tools and their impact on AlphaSense.

The True Cost of Unstructured Analysis

Without a framework, businesses make several critical mistakes that can kill growth and leave them vulnerable.

- Missed Opportunities: You fail to spot emerging trends or gaps in the market that a new product or service could have filled perfectly.

- Flawed Strategies: Your big decisions are based on incomplete or old information, leading to poorly-timed marketing campaigns or misguided product development.

- Wasted Resources: Your teams burn valuable time manually digging for data instead of analyzing it, often duplicating work and leading to frustration and burnout.

Ultimately, a dedicated platform like Zemith.com is the engine that brings your framework to life. It automates the painstaking work of data collection, organizing all that competitor intelligence into one central, actionable dashboard. This frees your team from reacting to the past so they can focus on building the future.

Building Your Framework’s Core Components

Think of a competitive analysis framework like building a custom race car. You wouldn't just throw in any old parts; every single component is chosen for a specific purpose and has to work perfectly with the others. If one part fails, the whole car sputters. Your framework is the same—its power comes from getting the core components right so you can take action.

It all starts with a simple but surprisingly tricky question: who are you really competing against? It’s tempting to just keep an eye on the big, obvious rivals, but the real competitive landscape is always much bigger and more complex than it first appears. To get the full picture, you need to identify and sort your competitors into a few different buckets.

Identifying Your Competitors

Your analysis has to dig deeper than just your direct rivals—the companies offering a similar product to the same customers. To truly build a robust approach, understanding a complete competitor analysis framework is essential. It helps you see all the players on the field, not just the ones right in front of you.

Here’s a practical way to categorize them:

- Direct Competitors: These are the names that pop into your head immediately. They sell a nearly identical solution to your exact target market. Think another AI-powered productivity suite that does everything yours does.

- Indirect Competitors: These businesses solve the same fundamental problem for your customers, but they do it with a totally different solution. For instance, a company offering separate, specialized tools for document summaries, coding help, and image creation is an indirect competitor to your all-in-one suite.

- Emerging Competitors: These are the newcomers, the disruptors, the startups that could come out of nowhere and snatch up market share with a fresh idea or new technology. You have to watch these players closely, as they can completely change the game when you least expect it.

Once you have a handle on who to watch, the next step is deciding what to watch. This is where you create a checklist of metrics to track consistently over time.

Selecting Your Key Metrics

This is the part that turns your framework from a simple list of names into a real strategic weapon. The goal here is to gather data that gives you a 360-degree view of a competitor's strategy, their performance, and how the market perceives them.

A great place to start is with market share. It’s a cornerstone of any solid analysis because it gives you a hard number on where a company stands against its rivals. In fact, firms that regularly track market share are 30% more likely to grow revenue faster than their competitors. And with 58% of executives now calling it a top priority for strategic planning, its importance is clear.

Beyond market share, your checklist should definitely include:

- Pricing and Promotions: What are their pricing models? Are they constantly running discounts or special offers?

- Product Features and Updates: What’s on their product roadmap? How fast are they shipping new features? Do they have any unique capabilities you don't?

- Share of Voice (SOV): How visible are they online? This includes their social media presence, search engine rankings, and any paid ads they're running.

- Customer Sentiment: What are people saying about them? Dive into reviews and social media mentions to get a feel for how their brand and products are perceived.

Trying to track all of this manually is a surefire way to drive yourself crazy. It's incredibly time-consuming and riddled with human error. A competitor could launch a new product or slash their prices overnight, and if you’re relying on someone to check their website once a week, you'll always be a step behind.

The real power of a modern competitive analysis framework comes from automation. Maintaining a real-time view of the market isn't a luxury anymore; it's a necessity for staying in the game.

This is where a centralized platform like Zemith becomes your unfair advantage. Instead of drowning in spreadsheets and a sea of open browser tabs, Zemith acts as your central command center, automatically pulling in, organizing, and analyzing these different data points for you. With Zemith, you get a single, actionable dashboard that monitors competitor websites, pricing pages, and marketing campaigns in real-time, freeing your team from tedious data entry so they can focus on crafting winning strategies.

Choosing the Right Analytical Models

So, you've identified your competitors and know what metrics to watch. Now what? The next step is picking the right analytical model to make sense of all that data.

Think of these models as different lenses for a camera. Each one gives you a unique perspective on the competitive landscape. A wide-angle lens shows you the big picture, while a macro lens reveals the tiny details. The secret is knowing which lens to use for which shot.

This isn’t about just dusting off every model you learned in business school. A competitive analysis framework is about strategically choosing the tools that will answer your most pressing questions and turn raw data into a clear picture you can actually act on.

Demystifying Common Analytical Models

Forget the dense textbook definitions for a moment. Let's talk about how these models work in the real world. Each one is designed to shine a light on a different part of your competitive environment, from your own internal operations to broad market forces. This is where you connect the dots and build a strategic story.

Proven models like SWOT, PEST, and Porter’s Five Forces are the bedrock of understanding market dynamics. For example, the classic SWOT analysis—evaluating Strengths, Weaknesses, Opportunities, and Threats—is used by over 75% of firms during major strategic moves like a product launch.

It’s not just for show, either. Businesses that apply these frameworks correctly report a 20%-25% higher likelihood of spotting competitive gaps and uncovering innovation opportunities. That kind of insight has a direct line to market share and profitability.

To give you a better idea, here’s a quick rundown of a few key models and when you might pull them out of your toolkit:

- SWOT Analysis: This is the classic all-rounder. Use it for a quick, high-level snapshot of your position against a competitor. It’s perfect for quarterly strategy meetings or kicking off a new marketing campaign.

- Porter's Five Forces: This is your go-to for assessing how attractive an entire industry is. Are you thinking about entering a new market? This model helps you understand the underlying forces at play, like the bargaining power of your customers or the threat of new startups.

- Feature Comparison Matrix: Absolutely essential for any product-focused company. A SaaS business, for instance, would use this to map its features against its top rivals. It instantly shows you where the gaps are—and where your next big opportunity might be.

- PEST Analysis (Political, Economic, Social, Technological): This is for seeing the forest, not just the trees. A PEST analysis helps you understand the macro trends that could shake up your whole industry, like new data privacy laws or shifting consumer values.

Choosing Your Competitive Analysis Model

To help you decide which model fits your needs, think about the core question you're trying to answer. Are you looking inward at your own capabilities, or outward at the market? This table breaks down the most common models to guide your choice.

| Model | Primary Focus | Best Used For | Key Question It Answers |

|---|---|---|---|

| SWOT Analysis | Internal & External | Quick strategic planning, competitor comparison, internal reviews. | "What are our advantages and disadvantages right now?" |

| Porter's Five Forces | Industry Structure | Evaluating market profitability, new market entry, long-term strategy. | "How structurally profitable is this industry?" |

| PEST Analysis | Macro-Environment | Long-range forecasting, risk assessment, market expansion strategy. | "What external factors could impact our entire industry?" |

| Feature Comparison | Product & Service | Identifying product gaps, prioritizing feature development, sales enablement. | "How does our product stack up against the competition feature by feature?" |

Ultimately, the best approach often involves using more than one model. A PEST analysis might reveal a new technological trend, which then informs the "Opportunities" section of your SWOT analysis. They work together to build a complete, multi-dimensional view of your landscape.

From Manual Models to Automated Insight

In the past, applying these models meant hours hunched over a spreadsheet. You'd painstakingly gather data, plug it into your cells, and hope the information wasn't already stale by the time you hit "save." It was slow, frustrating, and nearly impossible to do consistently.

That’s the exact problem modern platforms are designed to solve. The analytical models themselves are as valuable as ever, but technology has completely changed how we use them.

The goal isn't just to complete a SWOT analysis; it's to have a living SWOT analysis that updates as the market changes, giving you a continuous stream of strategic insight without the manual grind.

Platforms like Zemith embed these powerful models directly into your workflow. It provides pre-built templates that automatically populate with the live competitor data it’s already collecting for you. Imagine clicking a "Feature Comparison" template and watching it instantly fill with the latest product updates from your top rivals. This transforms sophisticated analysis from a once-a-quarter chore into a daily capability. If you want to push your team's analytical power even further, you can explore the best AI tools for research to supplement your efforts. By automating the grunt work, Zemith lets you and your team focus on what really matters: interpreting the results and making your next winning move.

Your Step-By-Step Implementation Roadmap

Turning theory into action is all about having a clear, repeatable roadmap. Building a competitive analysis framework isn't some huge, one-off project; it’s a series of manageable steps that you follow consistently. When you approach it this way, you ensure your work is focused, efficient, and actually helps you reach your business goals.

Think of this process as a cycle, not a straight line you cross once. Each of these six phases builds on the last, creating a powerful system for continuous market intelligence.

Step 1: Define Your Goals

Before you even think about looking at the competition, you need to look in the mirror. What are you actually trying to accomplish? A vague goal like “understand our competitors” is pretty much useless. You need to get specific and set measurable objectives that will guide your entire analysis.

For instance, are you trying to pinpoint gaps in their product line to shape your Q4 roadmap? Or maybe you need to figure out their pricing strategy because you're losing customers. Getting crystal clear on your goal is the most important first step—it dictates every decision that follows, from the data you collect to the analytical models you choose.

Step 2: Identify Your Competitors

With your goals set, you can now build a list of your rivals. And as we've talked about, this isn't just about the obvious, direct competitors everyone knows. You absolutely must include:

- Indirect Competitors: These are the businesses solving the same customer problem you are, but with a completely different type of solution.

- Emerging Competitors: Keep an eye out for the new, nimble players. They might be using fresh tech or a different business model that could shake things up fast.

A classic mistake is to focus only on the big, famous names in your industry. I see it all the time. But that kind of "aspirational" analysis often causes you to completely miss the smaller, hungrier companies that are actively stealing deals from you right now.

Step 3: Gather Intelligence

Alright, this is where the real work begins. It’s often the most time-consuming phase, too. You'll need to collect data on all those key areas you identified earlier—things like pricing, product features, marketing campaigns, and what customers are saying in reviews. Trying to do this manually is a slow, painful, and error-prone process that will drain your team's energy and resources.

This is precisely where a centralized platform becomes a force multiplier. Instead of tying up your team for weeks manually scraping websites and wrestling with spreadsheets, you can automate the entire intelligence-gathering process.

Tools like Zemith are built for exactly this. Think of it as your always-on market scout that automatically monitors competitor websites for pricing changes, tracks new marketing campaigns, and pulls in customer sentiment from all over the web. It turns a massive project into a smooth, ongoing process, freeing up your team to focus on what really matters: strategy. Of course, organizing all this data effectively is crucial; you can learn more about proper research data management to keep your insights clean and easy to access.

Step 4: Analyze Your Findings

Data without analysis is just noise. Now it's time to apply those analytical models we covered—like SWOT, Porter's Five Forces, or a Feature Comparison Matrix—to make sense of the intelligence you've gathered. The key is to pick the model that directly connects back to the goals you set in Step 1.

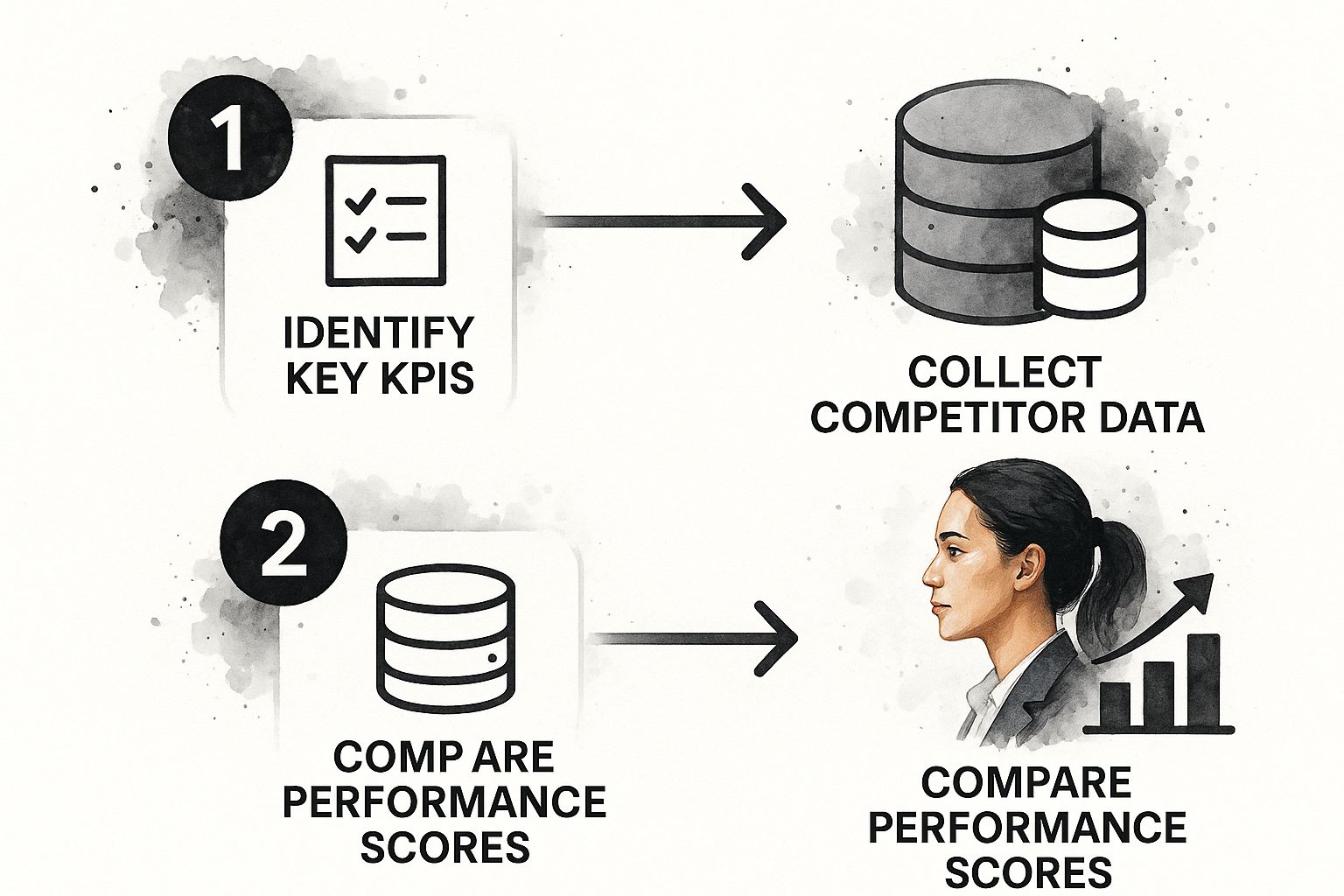

This process flow shows how to move from raw data to a clear comparison.

The main takeaway here is that you need a structured approach. It's the only way to turn a bunch of scattered data points into a cohesive story that informs your strategy.

Step 5: Report and Share Insights

All this great analysis is worthless if it doesn't get to the right people in a way they can actually use. Trust me, a dense, 50-page report will just sit on a digital shelf collecting dust. Instead, create concise, visual dashboards or brief summaries that get straight to the point, highlighting the most critical findings and recommended actions.

Your goal is to empower decision-makers, not bury them in data. Tailor your reports to your audience. The product team needs to see the feature-gap analysis, while the marketing team needs to understand the competition's messaging and positioning.

Step 6: Refine and Repeat Continuously

The market never sleeps, and neither should your competitive analysis. The final step is to turn this whole process into a continuous loop. Schedule regular check-ins—maybe monthly or quarterly—to update your data, revisit your analysis, and tweak your strategy as needed.

Treat your framework as a living, breathing system. By constantly refining your process, you’ll not only react to market shifts but actually start to anticipate them. That’s how you build a real, sustainable competitive advantage.

Turning Competitive Insights Into Action

A perfectly crafted competitive analysis is impressive, but let's be honest: it’s worthless if it just sits in a folder. Gathering data is only the beginning. The real magic happens when you translate those findings into decisive strategies that actually move the needle for your business.

This is where so many companies get stuck. They build beautiful reports that get a nod in a meeting and are then promptly forgotten, never influencing day-to-day decisions. To avoid this common pitfall, you have to build a direct bridge from insight to execution. Your goal is to make your framework a living, breathing part of your operational rhythm, not just a one-off research project.

From Data Points to Strategic Wins

Let’s get practical. A competitive analysis framework truly comes to life when it helps you answer high-stakes questions and directly informs your next move. It’s all about spotting an opportunity or a threat and having the clarity and agility to act on it—fast.

Think about these real-world scenarios:

Pricing Intelligence in Action: An e-commerce brand, let’s call them Company A, used its framework to track competitors’ inventory. They noticed a key rival was constantly out of stock on three of its best-selling items. Instead of just noting it, they launched a targeted ad campaign for those exact product categories, hammering home their reliable inventory and next-day shipping. The result? A 10% increase in market share for those products in a single quarter.

Smart Messaging Shifts: A B2B SaaS company, Company B, was monitoring competitor messaging. They saw their main rival quietly shift its website copy from "ease of use" to "enterprise security." Reading between the lines, they knew the competitor was trying to move upmarket. Company B quickly launched a counter-campaign that highlighted its own powerful security features but at a price point perfect for SMBs. They defended their turf and scooped up customers who felt left behind.

These examples drive home a critical point: a great framework isn't about looking in the rearview mirror. It's about knowing what to do next.

Activating Your Insights with the Right Tools

The bridge between insight and action is almost always built with technology. Waiting for a monthly report to tell you that a competitor dropped their prices two weeks ago is a recipe for failure. The market simply moves too quickly. To win, you need a system that enables you to be nimble and decisive.

This is exactly what a platform like Zemith is built for. It’s not just a place to store data; it's an active intelligence engine.

An effective framework should do more than just present data. It must trigger action. Real-time alerts and collaborative dashboards are the mechanisms that turn passive analysis into a proactive competitive advantage.

Imagine your framework is tracking competitor pricing. Instead of you manually checking websites every day, Zemith can fire off an instant alert to your product and marketing teams the moment a price changes. That single alert can kickstart a pre-planned playbook: review our pricing, launch a flash sale, or update our sales battle cards. What used to be a days-long reaction becomes a response measured in hours.

Fostering a Culture of Action

While technology is a powerful enabler, the ultimate success of your framework hinges on your team's culture. You have to empower people to actually use the insights you're generating. This means creating a clear, repeatable process for how findings are shared, discussed, and acted upon.

- Collaborative Dashboards: Get everyone looking at the same real-time data. Shared dashboards in a tool like Zemith break down silos, ensuring sales, product, and marketing all share a unified view of the competitive landscape.

- Action-Oriented Meetings: Stop having meetings that are just data dumps. Frame your competitive intelligence reviews around decisions. The agenda shouldn't be "What happened?" but rather, "Based on this, what are we going to do?"

- Clear Ownership: Assign responsibility. When a competitor launches a new feature, the product manager is the designated point person to lead the analysis and response. No more confusion or dropped balls.

Organizing these insights and action plans is crucial for keeping up the momentum. Many teams find that applying smart document management best practices helps keep their competitive intelligence organized and accessible. By creating a system where information flows seamlessly to the right people, you build an organization that doesn’t just watch its competitors—it consistently outmaneuvers them.

Frequently Asked Questions

https://www.youtube.com/embed/0KyCAcV_y7o

Even with the best game plan, a few questions always come up when you start piecing together a competitive analysis framework. It’s a big move, strategically speaking, so it's only natural to have questions about how it all works in the real world. This section tackles the most common ones we hear, giving you clear answers to get you over any hurdles.

Think of this as the final tune-up for your strategic engine. We'll get into the right timing for your analysis, critical mistakes to sidestep, and how even the smallest businesses can build a powerful framework without breaking the bank.

How Often Should I Update My Competitive Analysis?

This is easily one of the most common—and most important—questions. The honest answer? It depends, but it's a lot more often than most businesses assume. The old-school approach of creating a massive, annual competitor report is completely obsolete. In today's market, a competitor can roll out a new product, slash their prices, or launch a new marketing blitz practically overnight.

The key is to find a rhythm that combines continuous, light-touch monitoring with less frequent, deeper strategic reviews.

- Continuous Monitoring (Daily/Weekly): You need to keep an eye on key signals almost in real-time. This means tracking things like competitor price changes, major website updates, new ad campaigns, and big press releases. If you miss these, you're already behind.

- Tactical Reviews (Monthly): This is a great cadence for your marketing and product teams. It's the perfect time to review shifts in competitor messaging, check out their content strategy, and gauge customer reactions. This helps you make smart, short-term adjustments.

- Strategic Reviews (Quarterly): A quarterly review is your chance to zoom out and go deep. This is when you should be updating your SWOT analysis, re-evaluating your market position, and assessing the bigger strategic moves your main rivals are making.

Trying to keep up with this manually is a recipe for burnout. The only way to maintain this kind of cadence without drowning in data is through automation.

The goal isn't just to "update" your analysis; it's to create a living, breathing intelligence system. A platform that automatically tracks key data points transforms this from a daunting task into a manageable, continuous process.

This is exactly where a tool like Zemith becomes a game-changer. It acts as your 24/7 market scout, automatically capturing those daily and weekly signals. This frees up your team to focus on the high-value strategic work during quarterly reviews, armed with fresh, accurate information instead of spending all their time just trying to play catch-up.

What’s the Biggest Mistake to Avoid in Competitor Research?

The single biggest mistake is what I call “aspirational analysis.” This is when you focus all your energy on the massive, industry-leading giants while completely ignoring the smaller, hungrier competitors who are actually stealing your customers. It’s tempting to get fixated on the "Goliaths" in your space, but more often than not, it's the "Davids" who pose the most immediate threat.

These are the companies showing up in the same sales calls, ranking for the same keywords, and talking about the same customer pain points. When you ignore them, you’re essentially giving them a free pass to chip away at your market share unnoticed.

Another critical error is treating your analysis like an academic project. A report that’s packed with data but has no clear, actionable "so what?" takeaways is a complete waste of time. Every single insight you uncover must be tied to a potential action—whether that’s tweaking your pricing, sharpening your marketing message, or prioritizing a new product feature. Your framework has to connect the dots between information and execution.

How Can a Small Business Afford a Real Framework?

This is a totally fair and common concern. A lot of small businesses think a sophisticated competitive analysis framework is a luxury they can't afford, something reserved for big corporations with huge budgets and dedicated teams of analysts. And in the past, they were mostly right. The manual labor involved in gathering and making sense of the data was immense.

But technology has leveled the playing field in a huge way. The rise of integrated AI platforms has made powerful competitive intelligence accessible to everyone.

Today, a small business can build a truly robust framework far more affordably than ever before. It comes down to being smart about your approach:

- Efficiency: Instead of hiring a team of analysts, you can use a single platform to automate the vast majority of the data collection and organization.

- Focus: A small business doesn't need to track 50 competitors. Start by focusing intensely on your top 3-5 direct and emerging rivals. That's where you'll get the most bang for your buck.

- Integration: Use a tool that combines data gathering with analysis. An all-in-one solution means you aren't stuck paying for multiple expensive, single-purpose subscriptions.

This is the exact problem Zemith was built to solve. It gives you an all-in-one AI workspace that weaves deep research capabilities right into your daily workflow. For a small business, this means you can automate competitor website monitoring, analyze their content, and organize your findings all in one place, for one predictable cost. It makes a powerful competitive analysis framework not just possible, but practical and affordable for businesses of any size.

Ready to stop guessing and start outmaneuvering your competition? Zemith provides the all-in-one AI platform you need to build a powerful, automated competitive analysis framework. Unify your research, analysis, and strategy in a single workspace.

Explore Zemith Features

Introducing Zemith

The best tools in one place, so you can quickly leverage the best tools for your needs.

All in One AI Platform

Go beyond AI Chat, with Search, Notes, Image Generation, and more.

Cost Savings

Access latest AI models and tools at a fraction of the cost.

Get Sh*t Done

Speed up your work with productivity, work and creative assistants.

Constant Updates

Receive constant updates with new features and improvements to enhance your experience.

Features

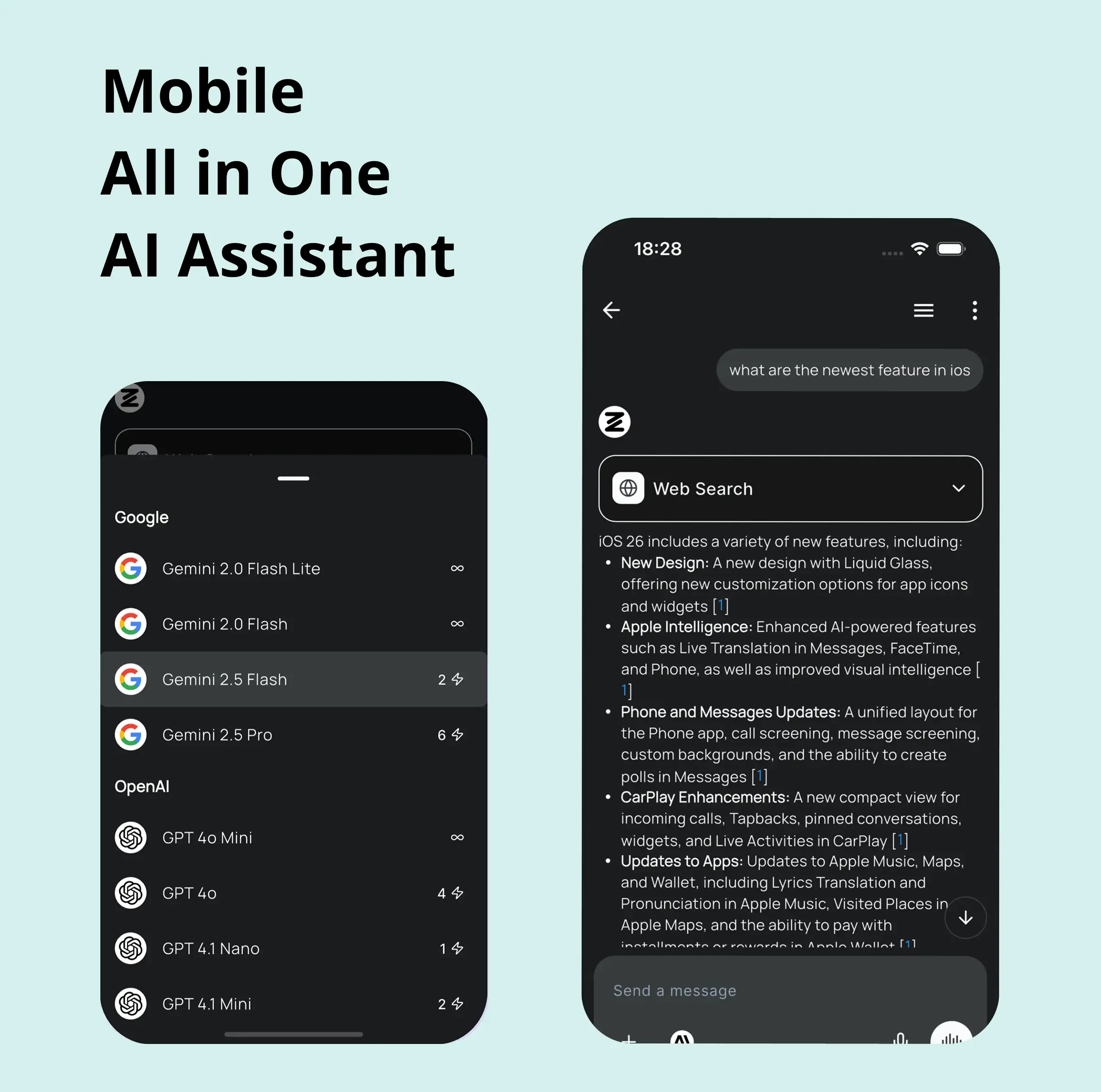

Selection of Leading AI Models

Access multiple advanced AI models in one place - featuring Gemini-2.5 Pro, Claude 4.5 Sonnet, GPT 5, and more to tackle any tasks

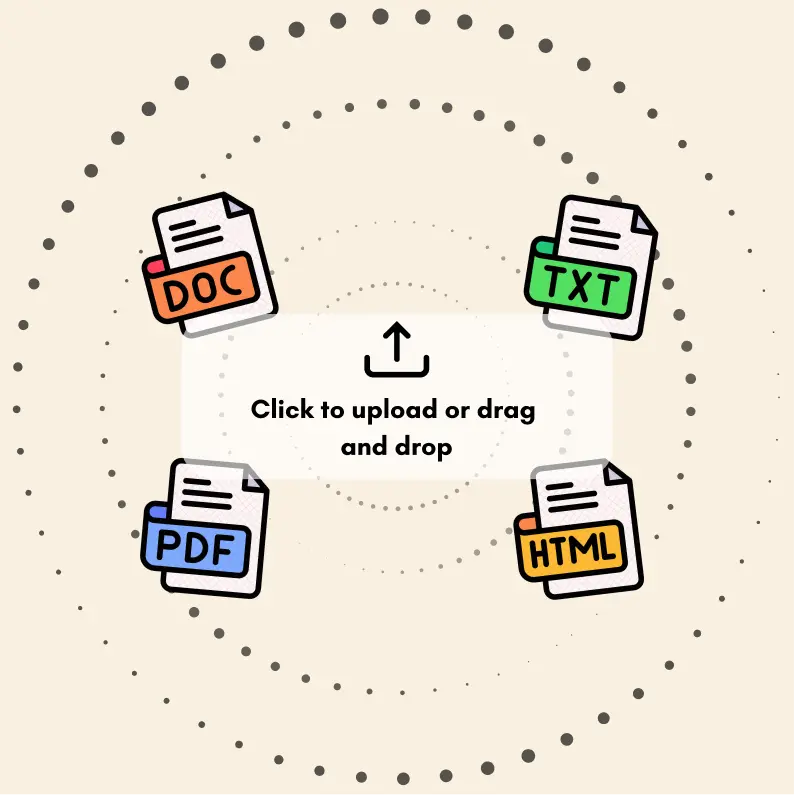

Speed run your documents

Upload documents to your Zemith library and transform them with AI-powered chat, podcast generation, summaries, and more

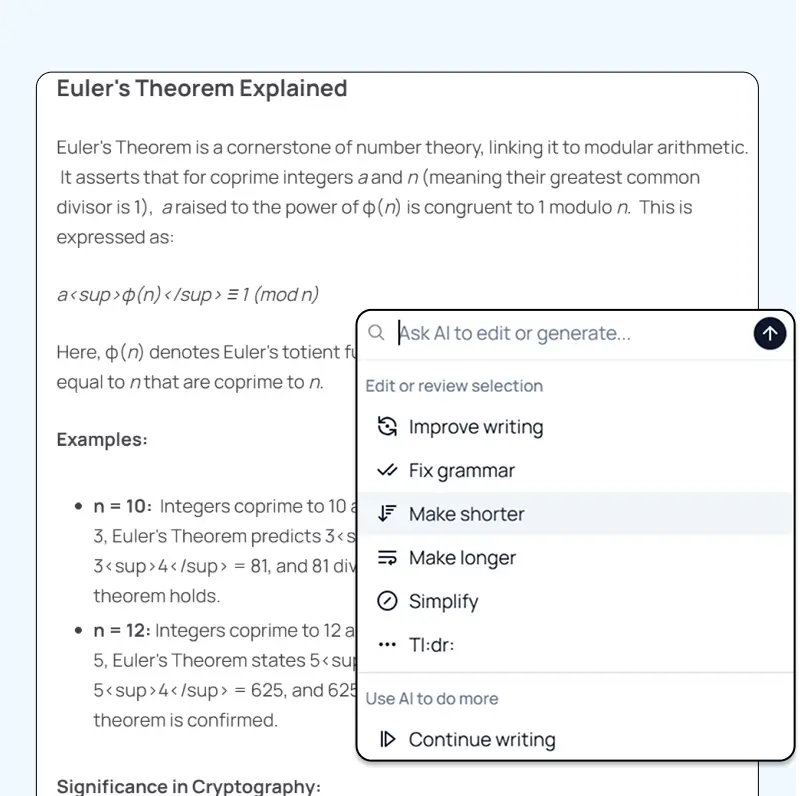

Transform Your Writing Process

Elevate your notes and documents with AI-powered assistance that helps you write faster, better, and with less effort

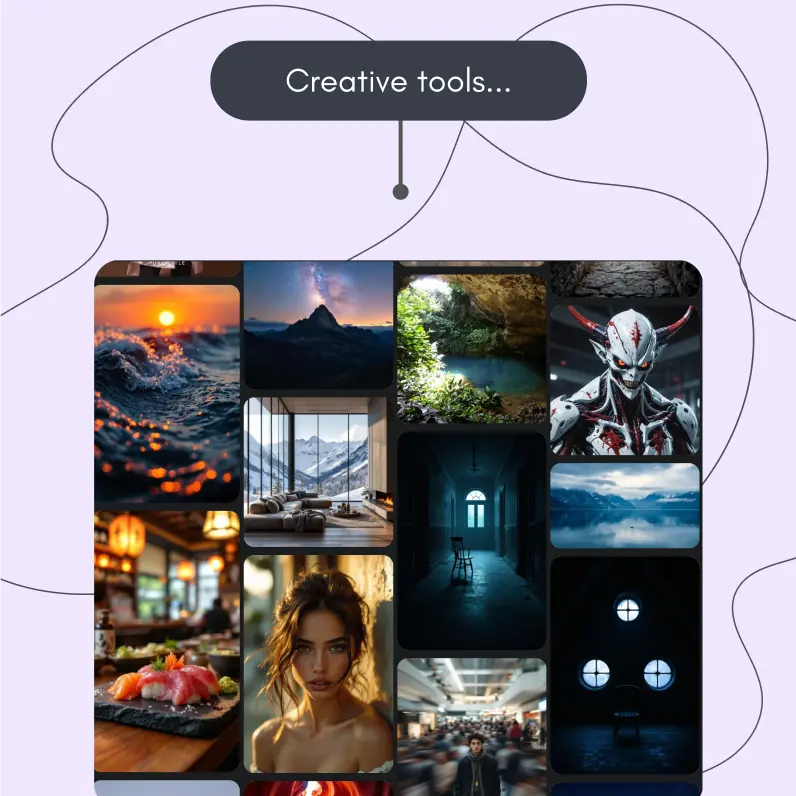

Unleash Your Visual Creativity

Transform ideas into stunning visuals with powerful AI image generation and editing tools that bring your creative vision to life

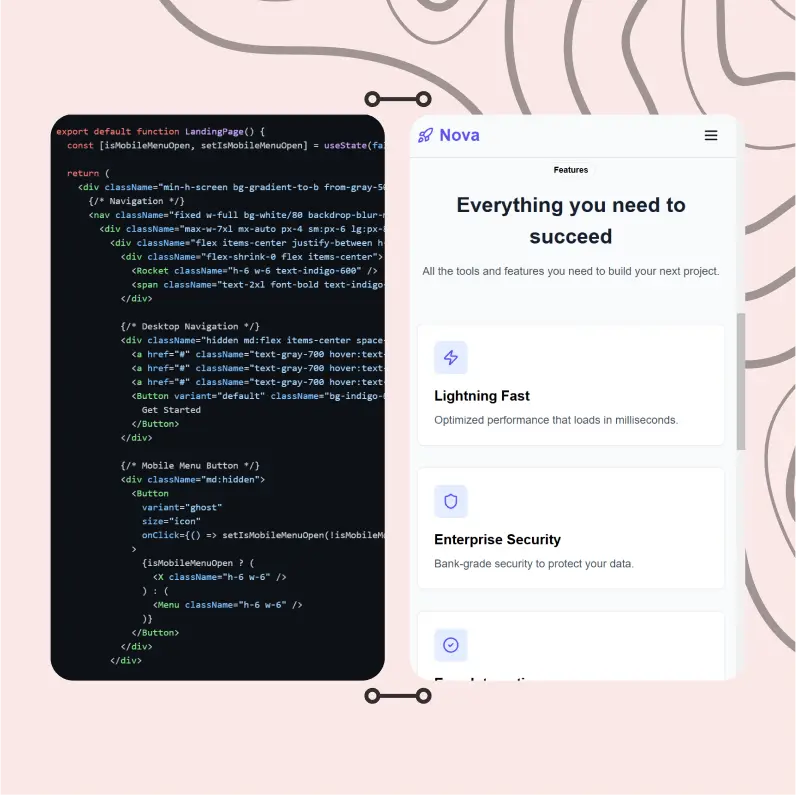

Accelerate Your Development Workflow

Boost productivity with an AI coding companion that helps you write, debug, and optimize code across multiple programming languages

Powerful Tools for Everyday Excellence

Streamline your workflow with our collection of specialized AI tools designed to solve common challenges and boost your productivity

Live Mode for Real Time Conversations

Speak naturally, share your screen and chat in realtime with AI

AI in your pocket

Experience the full power of Zemith AI platform wherever you go. Chat with AI, generate content, and boost your productivity from your mobile device.

Deeply Integrated with Top AI Models

Beyond basic AI chat - deeply integrated tools and productivity-focused OS for maximum efficiency

Straightforward, affordable pricing

Save hours of work and research

Affordable plan for power users

Plus

- 10000 Credits Monthly

- Access to plus features

- Access to Plus Models

- Access to tools such as web search, canvas usage, deep research tool

- Access to Creative Features

- Access to Documents Library Features

- Upload up to 50 sources per library folder

- Access to Custom System Prompt

- Access to FocusOS up to 15 tabs

- Unlimited model usage for Gemini 2.5 Flash Lite

- Set Default Model

- Access to Max Mode

- Access to Document to Podcast

- Access to Document to Quiz Generator

- Access to on demand credits

- Access to latest features

Professional

- Everything in Plus, and:

- 21000 Credits Monthly

- Access to Pro Models

- Access to Pro Features

- Access to Video Generation

- Unlimited model usage for GPT 5 Mini

- Access to code interpreter agent

- Access to auto tools

- 10000 Credits Monthly

- Access to plus features

- Access to Plus Models

- Access to tools such as web search, canvas usage, deep research tool

- Access to Creative Features

- Access to Documents Library Features

- Upload up to 50 sources per library folder

- Access to Custom System Prompt

- Access to FocusOS up to 15 tabs

- Unlimited model usage for Gemini 2.5 Flash Lite

- Set Default Model

- Access to Max Mode

- Access to Document to Podcast

- Access to Document to Quiz Generator

- Access to on demand credits

- Access to latest features

- Everything in Plus, and:

- 21000 Credits Monthly

- Access to Pro Models

- Access to Pro Features

- Access to Video Generation

- Unlimited model usage for GPT 5 Mini

- Access to code interpreter agent

- Access to auto tools

What Our Users Say

Great Tool after 2 months usage

simplyzubair

I love the way multiple tools they integrated in one platform. So far it is going in right dorection adding more tools.

Best in Kind!

barefootmedicine

This is another game-change. have used software that kind of offers similar features, but the quality of the data I'm getting back and the sheer speed of the responses is outstanding. I use this app ...

simply awesome

MarianZ

I just tried it - didnt wanna stay with it, because there is so much like that out there. But it convinced me, because: - the discord-channel is very response and fast - the number of models are quite...

A Surprisingly Comprehensive and Engaging Experience

bruno.battocletti

Zemith is not just another app; it's a surprisingly comprehensive platform that feels like a toolbox filled with unexpected delights. From the moment you launch it, you're greeted with a clean and int...

Great for Document Analysis

yerch82

Just works. Simple to use and great for working with documents and make summaries. Money well spend in my opinion.

Great AI site with lots of features and accessible llm's

sumore

what I find most useful in this site is the organization of the features. it's better that all the other site I have so far and even better than chatgpt themselves.

Excellent Tool

AlphaLeaf

Zemith claims to be an all-in-one platform, and after using it, I can confirm that it lives up to that claim. It not only has all the necessary functions, but the UI is also well-designed and very eas...

A well-rounded platform with solid LLMs, extra functionality

SlothMachine

Hey team Zemith! First off: I don't often write these reviews. I should do better, especially with tools that really put their heart and soul into their platform.

This is the best tool I've ever used. Updates are made almost daily, and the feedback process is very fast.

reu0691

This is the best AI tool I've used so far. Updates are made almost daily, and the feedback process is incredibly fast. Just looking at the changelogs, you can see how consistently the developers have ...